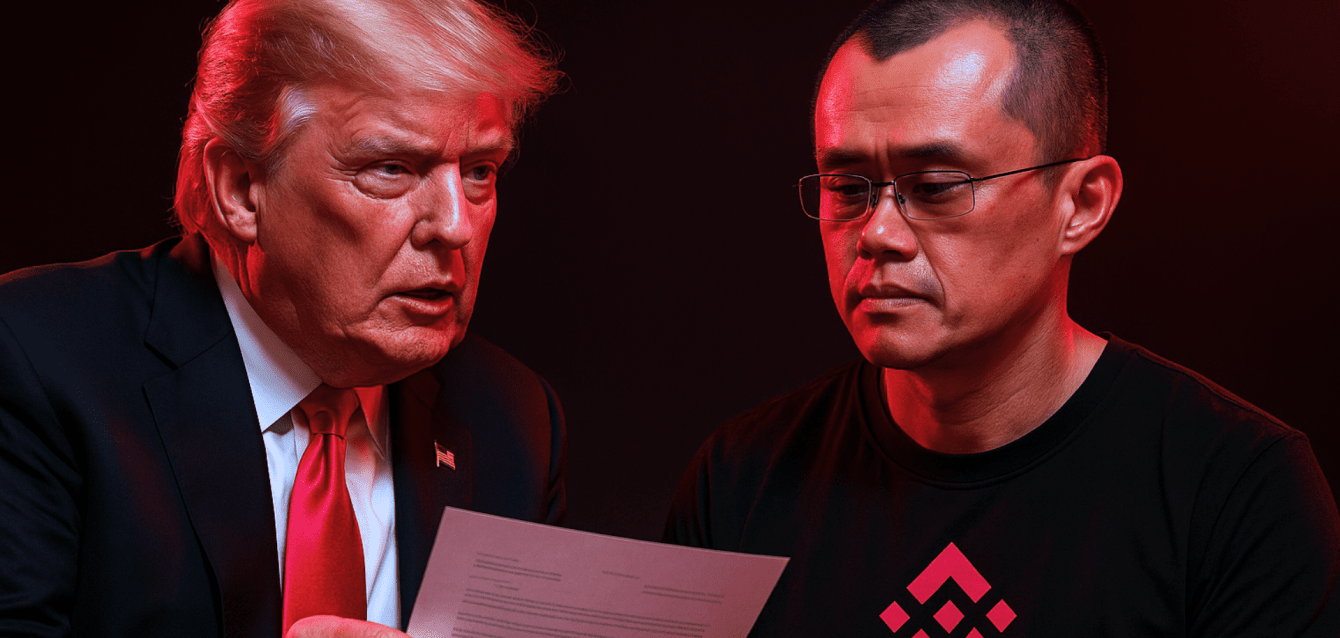

When Donald Trump signed the presidential pardon for Changpeng Zhao, the founder of Binance and once a major figure in crypto, it sent shockwaves far beyond Washington. For the first time in U.S. history, a president cleared the record of a convicted crypto executive. Markets reacted immediately: Bitcoin jumped, Binance Coin (BNB) surged, and crypto Twitter filled up with memes celebrating “CZ is back.” But beneath the excitement lies a deeper question: what does this political move really mean for the global crypto market, for Binance, and for the regulatory environment that has long shaped crypto’s uneasy connection with Washington?

The Symbolism of a Pardon

In 2023, Zhao pleaded guilty to not implementing enough anti-money laundering controls and served four months in prison—a humbling fall for a man whose exchange processed trillions in digital assets. Binance itself paid a record fine of $4.3 billion, agreeing to years of federal oversight.

Trump’s decision to pardon Zhao, described by the White House as a correction of “overreach in the war on crypto,” effectively erased his criminal record. According to reports from Reuters and BBC, the move restores Zhao’s business rights and opens up the chance for his active involvement in Binance’s future. The symbolism is strong. To many investors, it signals that the world’s largest economy is moving away from treating crypto as an enemy. To others, it serves as a warning that regulation may now be swayed by politics.

Market Reaction: Euphoria and Calculation

The market’s immediate response was predictably euphoric. Bitcoin rose about 4%, while Binance Coin jumped up to 15% before correcting. Some traders considered this the start of a new “altseason.” Memecoins linked to the Trump family’s ventures, including World Liberty Financial (WLFI), experienced double-digit gains. Yet, amid the price spikes, analysts called for caution. Legal experts pointed out that a presidential pardon does not clear the terms of Binance’s settlement with the U.S. Department of Justice or the exchange’s ongoing compliance obligations. Corporate lawyer Daniel Silva explained, “Zhao’s pardon changes the optics, not the oversight.” They argue that the short-term rally reflects sentiment more than solid fundamentals. Still, sentiment drives crypto—and for now, it has turned clearly bullish.

The Binance Question: A Door Reopened

Perhaps the most significant impact of the pardon is the new speculation about Binance’s return to the U.S. market. After years of distancing itself from Binance.US, the global exchange may now look to rebuild relationships with American regulators and investors. Industry insiders told Bloomberg that the company is exploring partnerships with institutional custodians and regulated brokers to facilitate a gradual return. A merger with Binance.US—once thought impossible—may now be back on the table.

If successful, such a comeback could inject billions in liquidity into the U.S. market. Analysts at AInvest estimate that Binance could quickly regain up to 20% of its lost American trading volume within a year. But that scenario depends on more than Trump’s support; it relies on the exchange proving that its compliance systems have improved beyond the issues that led to its prosecution.

Political Winds and Regulatory Shifts

For Trump, the pardon reinforces his image as the pro-crypto president. His administration has already focused on blockchain as a central part of U.S. innovation policy, supporting new stablecoin frameworks and legislation for digital assets. The idea of “America as the crypto capital of the world” resonates well with both libertarian voters and Silicon Valley donors. However, critics, including Democratic senator Elizabeth Warren, view the pardon as political favoritism. They highlight Binance’s ties to Trump-linked ventures, such as the launch of the $2 billion World Liberty stablecoin. Warren stated that the move “blurs the line between governance and personal interest.”

Regulators seem cautious but realistic. The Commodity Futures Trading Commission (CFTC) and Treasury Department have not canceled their oversight programs. Instead, they stress that Binance—pardon or not—still must adhere to AML and sanctions compliance. As one former SEC official put it, “Crypto may have a friend in the White House, but not a free pass.”

What It Means for the Global Crypto Ecosystem

Worldwide, the pardon suggests a potential thaw in U.S.-crypto relations—a shift that could unleash new waves of investment and innovation. Venture funding for digital assets, which dropped sharply during the regulatory crackdown of 2022–2024, is already rebounding. Institutional players, like Fidelity and BlackRock, who had paused their crypto exposure, now see less political risk in deepening their involvement.

However, it also sets a precedent. If crypto executives think that political connections can bypass accountability, regulators elsewhere—from the EU to Singapore—may respond with stricter rules. The world will watch to see whether the U.S. becomes a hub for innovation or a stage for selective enforcement.

The Road Ahead

For Zhao, the pardon signals a chance for redemption. For Binance, it’s an opportunity to rebuild trust. And for the wider crypto market, it serves as a reminder that politics and finance are more connected than ever. Whether this marks the beginning of a new golden age or just a temporary rally will depend on what happens next: will Binance reform and responsibly re-engage, or will old habits resurface under new leadership?

At Ruta, our team will continue to track how political and regulatory changes shape the future of crypto markets. We’ll keep you updated as the situation develops.